FCMM’s Option C Lifetime Fund provides a different approach from standard fund investments. Unlike the range of FCMM-available mutual funds (American, Vanguard, Timothy Plan, GuideStone), Christian Investors Financial adjustable rate, and FCMM managed stock and bond/income funds, a participant’s account value in Option C does not reflect the immediate rollercoaster ride of the markets. This collective investment fund uses a balanced investment strategy geared for a long timeline horizon.

Option C has provided stable value and steady growth for participants, essentially matching long-term market returns. Option C is sometimes characterized as the “do it for me” approach.

FCMM launched Option C in 2003 when the pension plan (Option A) was closed to new investments due to a structure that no longer fit market realities. The new Option maintained the annuity feature and philosophy of long-term, steady growth, but added management flexibility plus more choices for retirement distribution.

The fund is managed by professional investment advisers selected and overseen by the FCMM Trustees. The trustees determine the annual rate of return for participant accounts they consider to be sustainable from a long-term perspective, of past and anticipated market performance. Adjustments in the rate have been gradual; the rate can be negative if necessary in a major downturn.

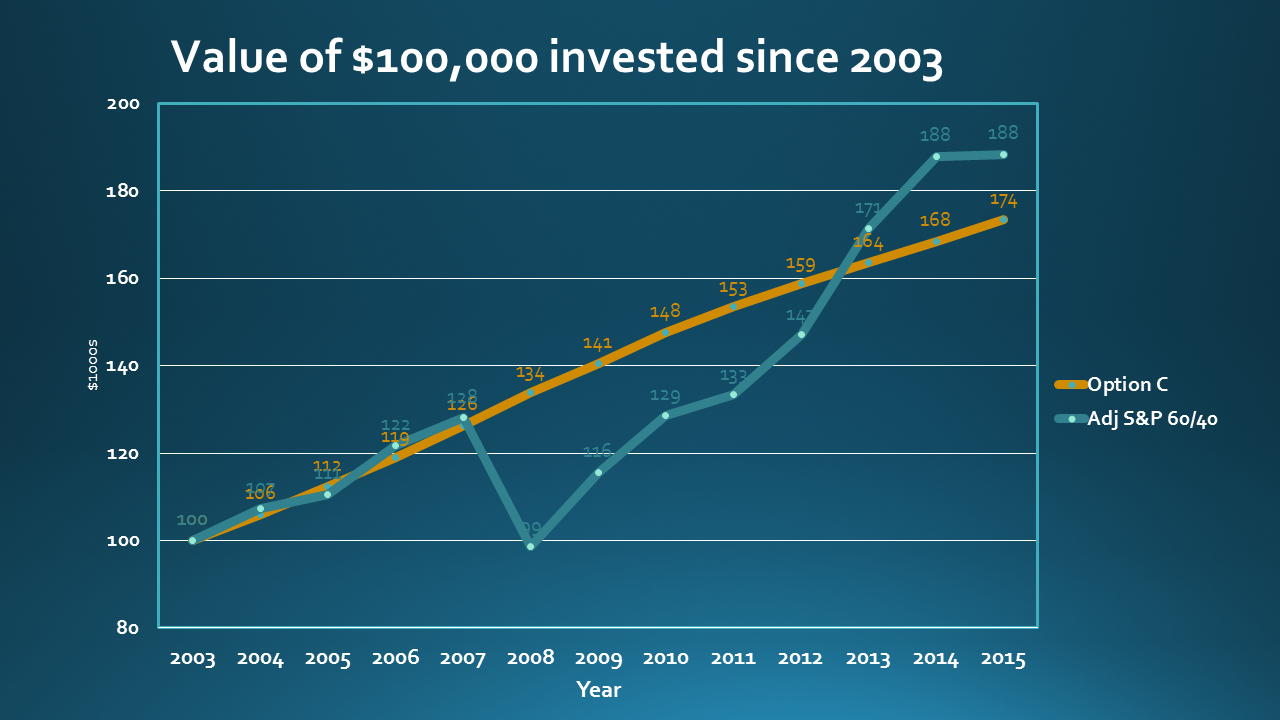

Market results for any given year vary widely. But Option C has maintained steady returns to the participant. In 2008, for example, the market took a steep decline and only gradually regained ground over several years. An Option C participant who planned to retire in 2008 or 2009 and take monthly income did not lose account value when the market dropped and did not need to postpone a planned retirement date.

Two accompanying graphs illustrate the difference. “Annual Earnings” compares year by year returns. “Value of $100,000 invested” compares the cumulative growth from an invested amount. (Option C participant earnings are compared to the same amount in a fund consisting of a standard 60/40% (equities/bonds) mix invested in Standard & Poor’s indexes. For comparison, the S&P mix returns were adjusted to account for investment fees, just as all FCMM fund returns are reported net of fees.)

The participant who utilizes Option C for a major portion of his/her retirement investments may more reliably target retirement without timing the date to market performance.

Each FCMM investor determines the allocation of his/her contributions to the various options. At present, about 25% of FCMM retirement contributions are directed by participants into Option C. For many, placing a substantial portion of funds in Option C represents a sound core strategy, along with directing some portion to other Options.

Because of the long time horizon for managing this fund, it is not recommended for those who want to move investments around. Option C funds can be transferred to another Option but transfers can be requested no more often than once in a 12-month period.

As with all assets in the Retirement Plan, the earliest age at which a participant can take retirement distributions is 59 ½. If the Option C participant wishes to take a cash ("lump sum") distribution rather than monthly income benefit ("in-plan annuity"), the distribution is subject to a market value adjustment if the underlying fund investment is lower than the accrued value. Converting an Option C amount to a monthly income benefit ("annuity") will apply the full balance without market adjustment to the benefit calculation.

For detailed information on distribution procedures, see the FCMM website.