On December 29, 2022, the SECURE ACT 2.0 was signed into law. The immediate effect changes the RBD to age 73 starting in 2023. Please note that any references below to age 72 should now be read as age 73 for persons turning this age in 2023. For any persons who became subject to RMDs prior to 2023, their annual RMDs will continue.

On December 20, 2019, the SECURE Act was signed into law, delaying one’s Required Beginning Date (RBD) for retirement distributions from age 70 ½ to age 72. The FCMM Retirement Plan will implement this new date, effective January 1, 2020, as allowed by the Act. Please note, this change is in effect ONLY for those who did not reach 70 ½ in 2019. (Those with a birthdate on or before 6/30/1949 will continue to have an RBD of April 1 following the year they turn 70 ½ or retire, whichever is later – see paragraph at the end of this article for more information.) The IRS has also proposed an update to the Uniform Lifetime Table that appears with this article, but any change to the table will not go into effect until 2021.

Required Minimum Distributions, also referred to as RMDs, are the minimum amounts that the Federal Government requires one to receive annually from retirement account(s), generally starting in the year a participant reaches age 72. RMDs are the Federal Government’s way of ensuring that it begins collecting its tax revenue (which has been deferred) on your retirement savings.

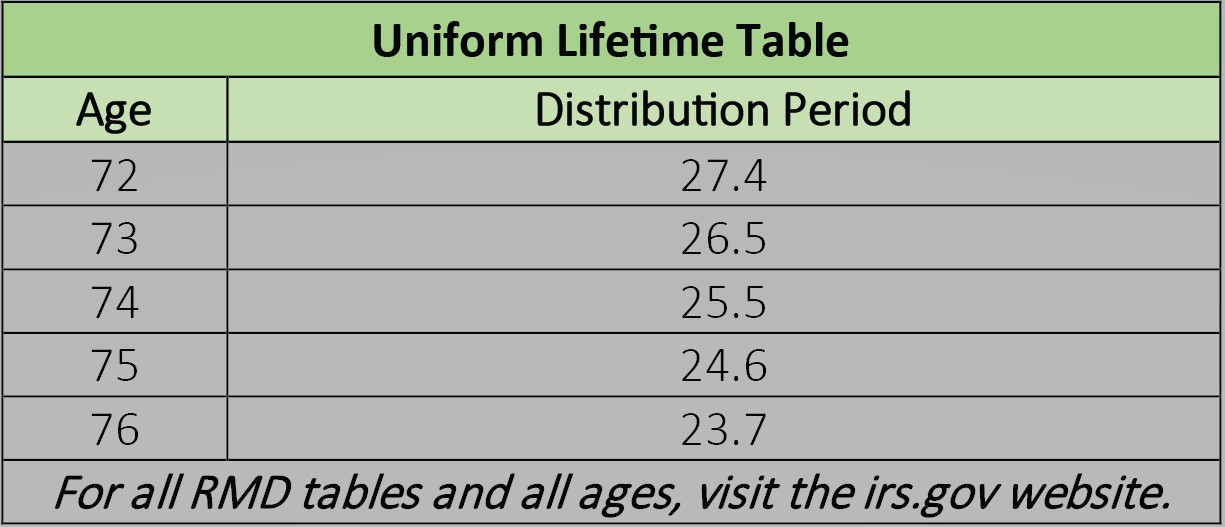

Failure to withdraw the total RMD amount by the IRS deadline results in a 50% penalty on the amount that isn’t withdrawn. If you’re required to receive an RMD, FCMM will calculate the amount you must receive for each RMD year and distribute it to you before the IRS deadline. In most cases, the RMD amount is calculated by dividing the prior year’s December 31 balance of your retirement plan account by an estimated distribution period, or “life expectancy factor”, associated with your current age. (See table.)

Required BEGINNING Date – When must I start receiving an RMD?

Unless your entire account has been converted to a lifetime benefit or you meet an exception, if you are 72 and have funds within a retirement account you must begin receiving annual RMDs. Generally, the IRS requires an individual to start receiving minimum distributions no later than April 1 in the year following the year in which one turns age 72. This is referred to as the “Required Beginning Date” (RBD). Unlike with an individual retirement account (IRA), FCMM allows for a “still working” exception that provides for a possible extension to the above mentioned RBD. This exception permits a participant working at least part-time for a Qualified Employer to postpone their RBD until they “retire”. The RBD for those under the FCMM Retirement Plan is April 1 of the year following the later of: the calendar year in which you turn 72 or the year you are no longer working at least 20 hours/week or 1000 hours/year for an organization that participates in the FCMM Retirement Plan.

After the first RMD, one must take subsequent RMDs by December 31 of each year beginning with the calendar year containing their RBD. A participant may not stop RMDs if they return to working for a Qualified Employer. Once RMDs start, they continue annually until a participant annuitizes their entire account or the account balance reaches zero. It is important to note that a participant is allowed to receive their first RMD prior to their RBD. If a participant waits until April to receive their first RMD it will result in the first RMD being received in the same year that the second RMD is paid. For some, the double RMD payment in the same tax year may push the participant into a higher tax bracket. Because of this, FCMM’s default date for all RMD payments is December 1, including the first year’s payment. If a participant wishes to have their first payment sent in April of the following year, it’s necessary to contact FCMM and specifically request this.

Satisfying your RMD

There is more than one way to satisfy your RMD from year to year. It’s important to understand the relationship between your RMD requirement and certain types of distributions over the course a single calendar year.

Rollover and Cash Withdrawal Requests

If an RMD is required for a calendar year, any amount distributed during that calendar year is treated as your RMD until your total RMD amount for that year is satisfied. This means that the earliest distribution requests of the year will always be considered RMD amounts. Accordingly, the IRS does not allow for the rollover of RMD amounts. For this reason, if a participant submits a request to rollout funds to a new custodian and has not yet met the RMD amount through previous distributions, FCMM is required to distribute the balance of the RMD amount directly to the participant prior to rolling over remaining funds.

Lifetime Benefit Arrangements (In-Plan "Annuities")

For the following explanations, Annuities, in respect to the FCMM Retirement Plan, refer to FCMM Monthly Income Benefit Payments.

1. Annuities starting on or before your RBD

Instead of receiving the amount calculated as one’s RMD in a single payment, the minimum distribution requirement may be satisfied by converting the participant’s entire FCMM account to an annuity so long as it starts on or before the RBD.

Example 1:

Participant A is no longer working and has turned 72 in 2020. He is required to take a 2020 RMD based on his 12/31/2019 account balance. The participant decides to annuitize his entire account in July of 2020. There is no need to add up his annuity payments to determine if they meet or exceed his RMD calculated amount. This annuitization satisfies his 2020 RMD because the annuitization occurred before his RBD of 4/1/2021 and he annuitized his entire account.

2. Annuities starting after your RBD

Generally, if a participant converts their entire account to an annuity after the RBD, the payments under the annuity contract will only automatically satisfy the RMD for distribution calendar years after the calendar year of conversion. In regard to satisfying the RMD for the year of conversion, the annuity payments will be treated as distributions from the account. The sum of these “distributions” will be compared to the calculated RMD to determine if the RMD is satisfied. If the sum of the “distributions” is less than the calculated RMD amount, the difference must be distributed to the participant to satisfy the RMD. The EXCEPTION to this is if a participant starts the annuity on January 1. A full twelve months of annuity payments in one calendar year satisfies that year’s RMD (as well as subsequent years).

Example 2a:

Participant B stopped working when she turned 72 in 2020 and therefore must receive a 2020 RMD. She elects to receive her first RMD payment on her Required Beginning Date of April 1, 2021. She will also receive her 2021 RMD payment in December of 2021. Participant B has decided to annuitize her entire account with a start date of 9/1/2022. Because the annuity starts after her RBD, it will not automatically satisfy the 2022 RMD. To determine if the annuity will satisfy the 2022 RMD, the total amount of annuity payments received must meet or exceed the RMD calculated amount based on 12/31/2021. If the sum of her annuity payments in 2022 total $900 for September, October, November, and December and her RMD calculated amount is $1200, the participant must receive a distribution for $300 prior to her first annuity payment in order to satisfy her 2020 RMD. The annuity will automatically satisfy the RMD for years after the year of conversion.

Example 2b:

If Participant B in the example above elected an annuity start date of 1/1/2022 (rather than 9/1/2022), it would not be necessary to add up her total payments for the year and compare them to the calculated RMD amount. The 2022 RMD is automatically satisfied with an annuity start date of 1/1/2022.

3. Partial Annuities

For annuity conversions made with only part of a participant’s account, either before the RBD or after the RBD, a special calculation needs to be applied as follows: In the year of conversion, the RMD is based on the total balance on 12/31 of the prior year. The payments received from the annuity in the year of conversion go toward reducing the RMD balance. Any remaining RMD balance must be taken from the participant’s non-annuitized assets. In the subsequent years, the RMD is calculated based only on the 12/31 value of non-annuity assets. The annuity payments received in the years following the year of conversion do not count toward satisfying the RMD, but rather the full RMD amount is paid from the non-annuitized assets.

Example 3:

Participant C has a Required Beginning Date of April 1, 2021. He has funds in Option C and Option D. He decides to only “annuitize” his Option C funds on January 1, 2021. His 2021 RMD is calculated using his account value of both Option C and Option D on 12/31/2020. To determine if his 2021 RMD amount is satisfied, we must add up the total amount of payments received in 2021 and compare that to the amount calculated and distribute additional funds if necessary. In 2022, however, we will only use the account value of his Option D funds on 12/31/2021 to determine the 2022 RMD amount.

Special Note for Those Born On or Before June 30, 1949

Although the principles for satisfying one’s RMD mentioned in the examples above apply to all FCMM Members, for those with birthdates on or before June 30, 1949, the Required Beginning Date (RBD) is unchanged by the SECURE Act and remains the later of April 1 of the year following the year one turns age 70 ½ or retires.

Example 4:

Participant D turned 70 ½ on November 3, 2019. In 2019, he continued to work fulltime for an employer that participated in the FCMM Retirement Plan and therefore was not required to receive a 2019 RMD. In March of 2020, Participant D “retires”. Because he turned 70 ½ in 2019, and he stopped working in 2020, he is required to receive a 2020 RMD even though he is only 71 in 2020. The RBD of age 72 provided by the SECURE Act does not apply to him.