Required Minimum Distributions (RMDs) are the minimum amounts the IRS mandates individuals to withdraw annually from their pre-tax retirement accounts, typically starting the year they turn 73. RMDs are the Federal Government’s way of ensuring collection of its tax revenue on your retirement savings*. FCMM encourages participants to stay up to date with RMD rules and understand how they apply to their FCMM 403(b)(9) account.

RMD Basics

Required Beginning Date (RBD)

While saving for retirement, the IRS allows individuals to defer taxes on pre-tax contributions made to their retirement accounts. However, individuals must eventually begin taking taxable withdrawals*. These mandatory withdrawals are known as Required Minimum Distributions (RMDs). Unless an exception applies, individuals must start receiving annual RMDs no later than April 1 of the year following the calendar year they turn 73 (age 75 starting in 2033). This April 1 deadline is referred to as the “Required Beginning Date (RBD)”.

Unlike with an individual retirement account (IRA), FCMM allows for a “still working exception” that provides for a possible extension to the above mentioned RBD, permitting a participant to postpone RMDs beyond age 73.

For participants in the FCMM Retirement Plan, the RBD is April 1 of the year following the later of:

● The calendar year in which the participant turns 73, or

● The calendar year in which the participant stops working at least 20 hours/week or 1,000 hours/year for a Qualified Employer.

Once RMDs begin, they must continue annually until the account balance is exhausted or the participant annuitizes their entire account. If a participant returns to work for a Qualified Employer after starting RMDs, those distributions must still continue. Unpaid RMDs are subject to IRS penalties.

*RMDs designated as eligible for the housing allowance exclusion in retirement will not incur taxation to the extent the funds are used for qualified housing expenses.

Calculating the RMD

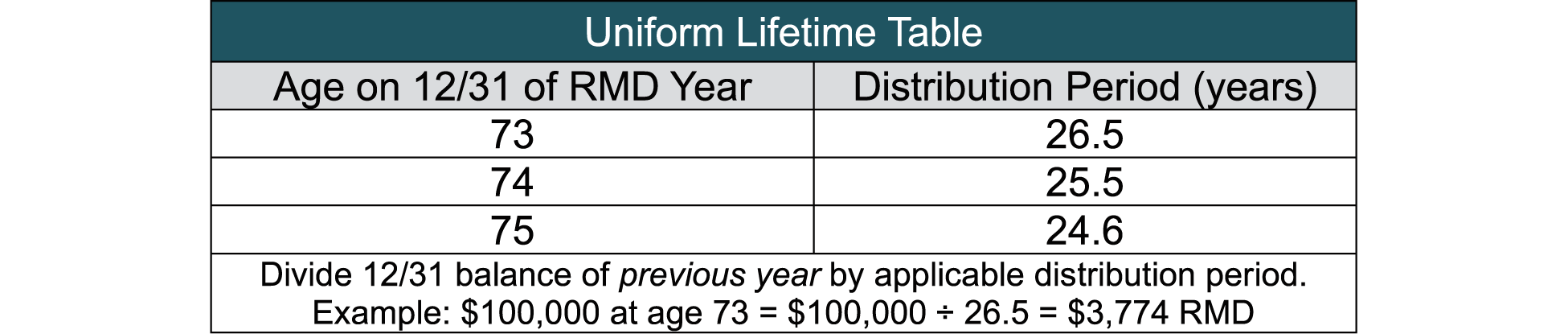

The IRS provides three life expectancy tables to calculate RMDs. These tables assign a distribution period (factor) based on one’s age at the end of the RMD year. The three tables are:

Single Life Table: Used for beneficiaries of inherited accounts.

Joint and Last Survivor Table: Used if the account holder’s spouse is the sole beneficiary and is more than 10 years younger than the account holder.

Uniform Lifetime Table: Used for all account owners unless they meet the criteria indicated for one of the other two tables.

To calculate an RMD, FCMM divides the prior year’s 12/31 pre-tax account balance by the applicable distribution period. FCMM notifies participants of their annual RMD calculation in the spring, and again mid-year. Participants may request their RMD payment at any time after the previous year’s ending balance is determined. FCMM’s default sending period for distributing RMD amounts to its participants starts in October each RMD year. The first RMD payment is the only RMD that may be delayed until April 1 of the following year. If a participant wishes to have their first RMD deferred until April, they must contact FCMM and specifically request this at least 30 days before the FCMM default payment period begins. Without timely notification, FCMM will automatically send the RMD payment starting in October of the RMD year.

Satisfying Your RMD

There is more than one way to satisfy the RMD obligation from year to year. It is important to understand the relationship between the RMD requirement and the different types of distributions available.

Cash Withdrawals

FCMM allows two types of cash withdrawals:

● One-time lump sum withdrawals

● Monthly recurring withdrawals

When an RMD is required for a calendar year, the first distributions of that calendar year are applied toward satisfying the RMD until the total RMD amount for that year has been paid out. Accordingly, the IRS also requires the full RMD amount be distributed directly to the participant before a rollout to another retirement account can occur.

Example 1: Participant A turned 73 in 2025 and plans to retire on December 31, 2025. Because he will end employment during the RMD calendar year, he does not meet the “still working exception” and must receive a 2025 RMD no later than April 1, 2026. Participant A receives his RMD in 2025, during FCMM’s default payment period, as a lump sum.

Example 2: Participant B is no longer working and will turn 73 in 2025. In January 2025, she requested FCMM to calculate her 2025 RMD, which totals $24,000. Participant B then set up a recurring cash withdrawal of $2,750 per month starting in March 2025. This will result in her receiving a total of $27,500 in 2025. Because this amount exceeds her RMD amount, the recurring cash withdrawal will satisfy her RMD for 2025. Participant B is encouraged to evaluate her recurring cash withdrawal amount annually to ensure it will meet the following year’s RMD requirement.

Monthly Income Benefit -“Annuity”

The FCMM Retirement Plan offers an in-plan method of converting some or all of a Member’s retirement account assets into a lifelong monthly income stream (“annuity”). Termed Monthly Income Benefit by FCMM, this income annuity is structured as a Single Premium Immediate Annuity (SPIA). For the following explanations, “annuity”, with respect to the FCMM Retirement Plan, refers to the FCMM Monthly Income Benefit.

Full Balance Annuity starting on or before your RBD

For Participants who convert their entire FCMM account balance to an “annuity”, on or before their RBD, all future RMD requirements are considered satisfied, provided no additional contributions are made to the retirement account.

Example 3: Participant C, age 74, stops working in 2025 and must take a 2025 RMD. In July 2025, he annuitizes his entire account. Because the annuitization occurred before his RBD of April 1, 2026, his 2025 RMD is satisfied, and no future RMDs are required provided no additional contributions are made to the retirement account.

Full Balance Annuity starting after your RBD

If a participant converts their entire account to an annuity after their RBD, only RMDs for subsequent years will be automatically satisfied. The RMD for the conversion year must still be calculated separately.

Example 4: Participant D’s first RMD year was 2023. She opted to delay this first RMD until her RBD of April 1, 2024, and accordingly, she also received her 2024 RMD in the same calendar year. She decided to annuitize her entire account starting September 1, 2025. Since the annuity will start after her RBD, her 2025 RMD must still be calculated. If her calculated 2025 RMD is $1200, and her annuity payments total $900 in 2025, the remaining $300 must be paid to her before the first annuity payment to satisfy her 2025 RMD. RMDs after the year of conversion will automatically be satisfied provided no additional contributions are made to the retirement account.

Example 5: If Participant D started her annuity on January 1, 2025, her 2025 RMD would be automatically satisfied.

Partial Balance Annuity

For annuity conversions funded with only part of a participant’s account balance, regardless of timing, a special calculation needs to be applied as follows:

In the year of conversion, the RMD is based on the total account balance on 12/31 of the prior year. The payments received from the annuity in the year of conversion go toward reducing the RMD balance for that year. Any remaining RMD balance after the sum of the annuity payments is considered must be taken from the participant’s non-annuitized assets. In subsequent years, the RMD is calculated based only on the prior year’s 12/31 value of non-annuity assets. The annuity payments received in the years following the conversion year do not count toward satisfying future RMDs, but rather the full RMD amount is paid from the non-annuitized assets.

Example 6: Participant E has an RBD of April 1, 2025, and has funds in both Option C and Option D. On January 1, 2025, he annuitizes his Option C funds. His 2025 RMD calculation is based on the combined value of Option C and Option D as of December 31, 2024. Payments from his annuity count toward his RMD for 2025 and any unmet RMD amount must be withdrawn from the non-annuitized funds in Option D. For 2026 and future years, RMDs will be calculated based only on his Option D account balance.

DEFINITIONS

Annuitize: Irreversible process of converting FCMM retirement funds into an FCMM Monthly Income Benefit (“Annuity”).

Distribution: Any payment made from a retirement account.

FCMM’s Default RMD Sending Period: The designated time of the year when FCMM sends all unpaid RMD balances to participants, initiated in October and continuing weekly through December.

Required Beginning Date (RBD): The deadline by which an individual must receive their first RMD (April 1 of the year following the first RMD Year).

Required Minimum Distribution (RMD): The minimum amount the IRS requires a participant to withdraw annually from their pre-tax retirement account upon reaching age 73 (age 75 as of 2033).

RMD Year: The calendar year in which an individual has a minimum distribution requirement.

Rollover: A transfer of funds from one’s retirement account to another.

Still Working Exception: Allows individuals working at least 20 hours/week, or 1000 hours/year, for an FCMM Qualified Employer, to delay the first RMD beyond age 73. This exception will only apply if the individual continues working beyond the RMD calendar year; an employment termination during the RMD year, even if on 12/31, disqualifies one for the exception.